I. Definition

Internet Banking is the service extended by ICBC through resourceful support by its technologies that provides the most advanced financial service in the country through Internet. For peer banks, it mainly includes Online Payment and Settlement Agency Service and Online Group Company Financial Planning.

II. Product Introduction

1. Online Payment and Settlement Agency Service

ICBC utilizes e-Financial to provide the convenient and prompt Online Payment and Settlement Agency Service to a variety of banks and credit cooperatives who signed on Agency Writing of Bank Draft Writing, Agency Acceptance of Bank Draft, Agency Inter-city Fund Transfer, and other payment and settlement services. The payment and collection services can be completed within ICBC system and can be completed across the banks.

2. Online Group Company Financial Planning

The peer banks, the investment trust companies, and the financial leasing companies may strengthen internal fund management and enhance resources allocation efficiency through Online Group Company Financial Planning of ICBC's Internet Banking.

III. Target Client

Peer banks and financial institutions with relevant business qualifications.

IV. Application Condition

Peer banks and financial institutions with relevant business qualifications are eligible for applications.

V. Solutions

1. Payment and Settlement Agency Service

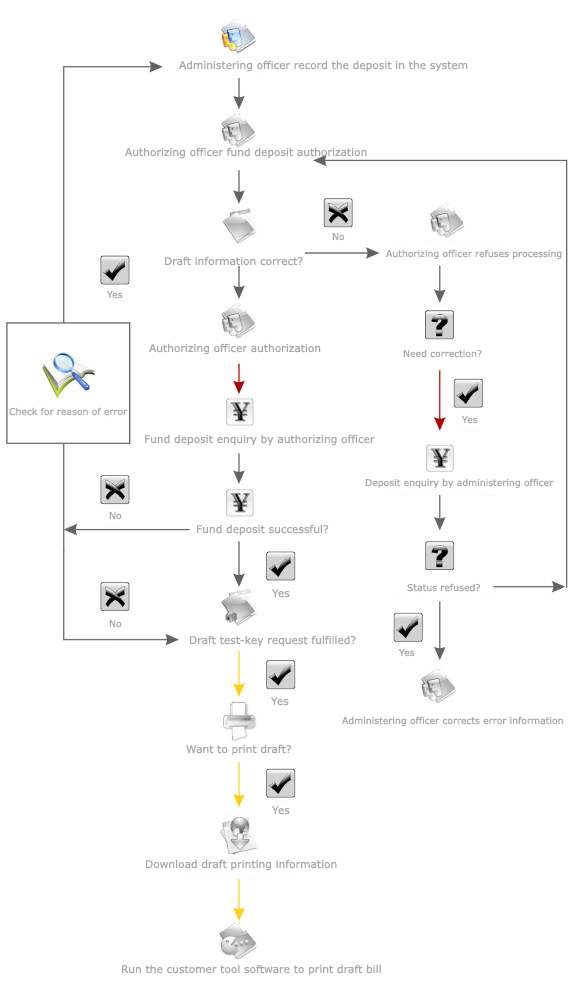

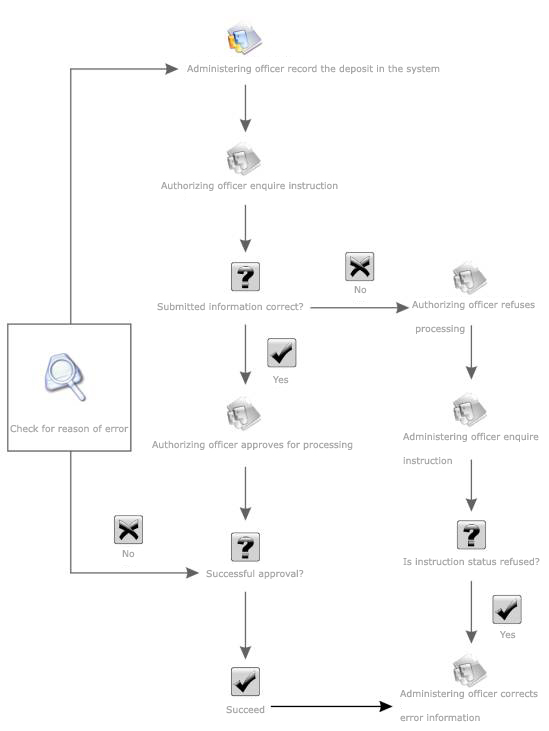

(1) Online Agency Writing of Bank Draft: ICBC Online Agency Writing of Bank Draft provides the draft fund deposit information key entry, instruction enquiry, draft test-key request, and draft printing. The peer bank logs onto ICBC Internet Banking system and inputs the information of draft writing, deposit the draft fund into ICBC, and through online test-key request, download draft printing information, and then print the draft bill through the client terminal software tools provided by ICBC.

(2) Online Agency Currency Exchange: ICBC Online Agency Currency Exchange provides the currency exchange voucher data entry and instruction enquiry function. The peer bank logs onto ICBC Internet Banking and input the payment instruction item by item as per the currency exchange vouchers supplied by its customers. It can swiftly complete the currency exchange for its customers without going through the interbank instrument exchange. The payee¡¯s bank can be ICBC or can be other commercial banks in other cities.

2. Online Group Company Financial Planning

After the group customer applies for Corporate Internet Banking, the system treats the HQ account at ICBC as the master account and treat the branch institution accounts at ICBC as the subsidiary accounts. The relevant HQ customer may allocate the fund in its branch institution's ICBC accounts, enquire relevant information, and practice internal financial control through ICBC Internet Banking, and thereby reduces the financial cost and increases the fund utilization.

VI. Features and Strengths

ICBC utilizes the dual advantages stemmed from its settlement network and the Internet Banking platform to provide the peer banks with Online Agency Writing of Bank Draft and Online Group Company Financial Planning. In comparison with the regular services, the Internet Banking features simple application procedures, low internal control risk, and fast work process.