|

I. Definition

ICBC provides insurance companies with Assets Custody, Fund Clearing, Accounting, Asset Appraisal, Transaction Monitoring, and Custodian Report services for insurance companies' proprietary fund, special service fund, and insurance funds in trust.

II. Product Introduction

1. Purely stock assets custody

2. Securities assets custody (assets under custody include stocks, bonds, and funds)

3. Whole Insurance assets custody (incl. securities assets and cash assets)

4. Insurance assets full custody

III. Target Client

Insurance companies needing insurance assets custodian services pursuant to requirement by China Insurance Regulatory Commission.

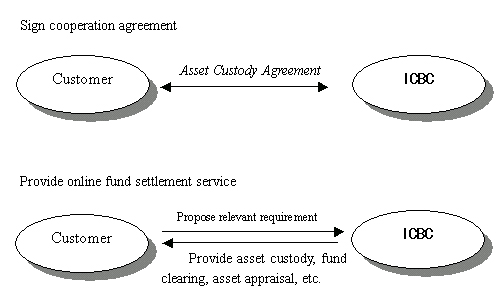

IV. Service Procedure

V. Features and Strengths

1. Ensure insurance fund security: it effectively prevents the embezzlement of insurance fund for other illegitimate purposes and ensures the fund security; meanwhile, the custodian bank undertakes the fund custody responsibilities and features fairly strong ability for risk remedies.

2. Conduct effective supervision over investment manager: As per requirement of the consignor's investment guideline, the custodian exercises supervision over the investment practice by the investment manager and the investment department of the insurance companies. It immediately advises the consigner upon any suspicion or violations, which forms the supervision mechanism. Through accounting and valuation by the custodian, the insurance companies may timely know the conditions of the entrusted assets and avoid the situation of "black-box" operation and the accompanying risks to the insurance assets.

3. Contribute to optimized allocation of insurance assets: Through pooling from different regions and different hierarchies, the service enables higher insurance fund utilization and efficiency. The pooled fund forms "fund pool", which is eligible for matching the duration of different products and the investment plan. It overcomes the shortcoming of low scale and efficiency in investments made by scattered fund and it creates more value.

4. Specialized operation efficiency - from the fund flow within the company till each step in insurance fund investment, the custodian pools the payment fund, supervises the investment practices, and conducts accounting on behalf of the consigner, and thereby enables the insurance companies to concentrate more on the insurance business development while the investment managers complete the investment deals with more focused attention and effectiveness. It provides systematic and real-time information and report to the insurance companies and regulatory institutions, enhancing the regulatory and supervision efficiency.

5. It helps insurance companies in reducing operating cost - reducing the internal fund operation cost and the funds are centralized for investment and supervision, which also reduces the investment cost. The link support between ICBC online system and the corporate system reduces the relevant system development and maintenance cost for companies. The service reduces the company's investment deployment and accounting cost. ICBC custodian professionals assist the insurance companies and the investment managers in fund account opening, securities account opening between the exchanges and the bank, account opening for open-end funds, and other investment preparations. It reduces the consigner's investment supervision cost and assists them in supplying information to the supervision authorities.

|