|

The normal SGD interest rate for the Elite Kids Account is 0.10% (“Normal Interest Rate”). An additional bonus rate of 0.10% will be given on top of the Normal Interest Rate if there is a minimum of SGD 500 increment in the daily average balance compared to the previous month (“Bonus Interest Rate”).

Please note that the Normal Interest Rate will be credited into the account on the 1st day of the month and the Bonus Interest Rate will be credited into the Account on the 2nd day of the month if the requirements are met.

Eligibility

Parents can open an Elite Kids Account on behalf of their kids who are under 16 years old for savings purpose. For every Elite Kids Account, there must be one accountholder who is below 16 years old. No signature, debit cards or internet banking would be issued to kids until he/she reaches 18 years old.

Documents to Apply for Elite Kids Account

|

|

Nationality

|

Documents Required

|

|

For Parents

|

Singapore Citizen /

Permanent Resident

|

Singapore NRIC

|

|

Foreigners

|

1.Passport (at least 6 months of validity)

2.Relevant Pass (issued by the Immigration and Checkpoint Authority of Singapore and at least 6 months of validity)

3. Proof of Address (either one of the documents listed below):

● Utility / Telephone bill

●Bank or credit card statements / Letter from other financial institutions in Singapore

●Employment pass record with MOM or letter from Singapore government (including any Ministry, Statutory Board and other government agencies)

●A letter with company letterhead from customers current employer for customers residing at temporary dormitories (e.g. construction workers)

● Tenancy agreement Accountholder's ID card in his/her home country

●Other document to show accountholder’s residential address

|

|

For Child

|

Singapore Citizen /

Permanent Resident

|

Singapore Birth Certificate

|

|

Foreigners

|

1. Passport (at least 6 months of validity)

2.Relevant Pass (issued by the Immigration and Checkpoint Authority of Singapore and at least 6 months of validity)

3. Proof of relationship documents (e.g. birth certificate)

|

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Elite Kids Account Interest Calculation

The account is entitled an additional bonus rate of 0.10% on top of normal rate of 0.10% if the average daily balance increases SGD500 from the previous month.

Average Daily Balance = Total amount of day-end balance for (xx) days in the month / number of days in the month(xx)

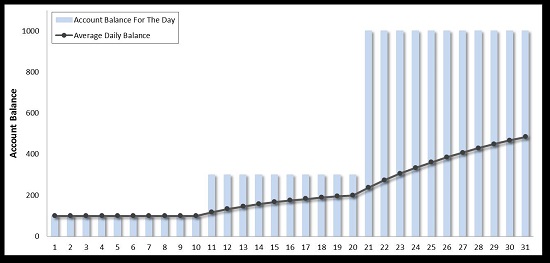

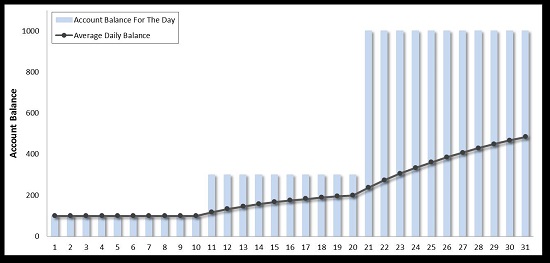

For Example : Below is a simple illustration on how Average Daily Balance is calculated:

● Your account has a day-end balance of $200 daily from 1 to 10 July, so total amount of daily balances for 10 days is:

$200 x 10 Days = $2,000.

● Your account has a day-end balance of $300 daily from 11 to 20 July, so total amount of daily balances for 10 days is:

$300 x 10 Days = $3,000.

● Your account has a day-end balance of $1,000 daily from 21 to 31 July, so total amount of daily balances for 11 days is:

$1,000 x 11 Days = $11,000

● Total amount of daily balances for 31 days in July is:

$2,000 + $3,000 + $11,000 = $16,000

● Average Daily Balance is therefore: $16,000 divide by 31 (number of days in the month) = $516.13

If Average Daily Balance(July) - Average Daily Balance(June) < $500, Elite kid account interest calculate by normal interest only.

If Average Daily Balance(July) - Average Daily Balance(June) ≧ $500, Elite kid account can enjoy both Normal Interest and Bonus Interest.

Normal Interest = Accumulate (Day-end Balance* Normal IR / 365)

Bonus Interest = (Accumulate Day-end Balance)* Bonus IR * / 365

For Example:

Elite kid Account Normal Interest = $200*0.10%*1/365+…$1000*0.10%*1/365 = $0.04

Elite kid Account Bonus Interest = ($200*10+$300*10+ $1000*11)*0.10% /365 = $0.04

Normal Interest and Bonus Interest will be automatically computed and credited once every month for current account. Normal interest credit is on the 1st day of the month. Bonus Interest credit is on 2nd day of the month.

|